Revisiting a Tiny House Retirement Plan

As markets tumble and retirement accounts begin to take a beating, the notion of holding real tangible assets comes to the front of many people’s minds. When money is in the bank, or investment brokerage, it’s subject to outside forces in a way useful tangible assets you hold yourself are not.

During good times some of these outside influences can be beneficial and you may see balances soar. During tough times you may see the opposite.

During the crash in 2007/8, we saw many people loose huge amounts of money, forever altering their retirement plans. We saw people loose so much equity in their homes it pushed them into foreclosure and bankruptcy. The big lesson learned is that outside forces are also sometimes outside our ability to manage comfortably. To avoid disaster, consider taking more control of your assets and hold them yourself.

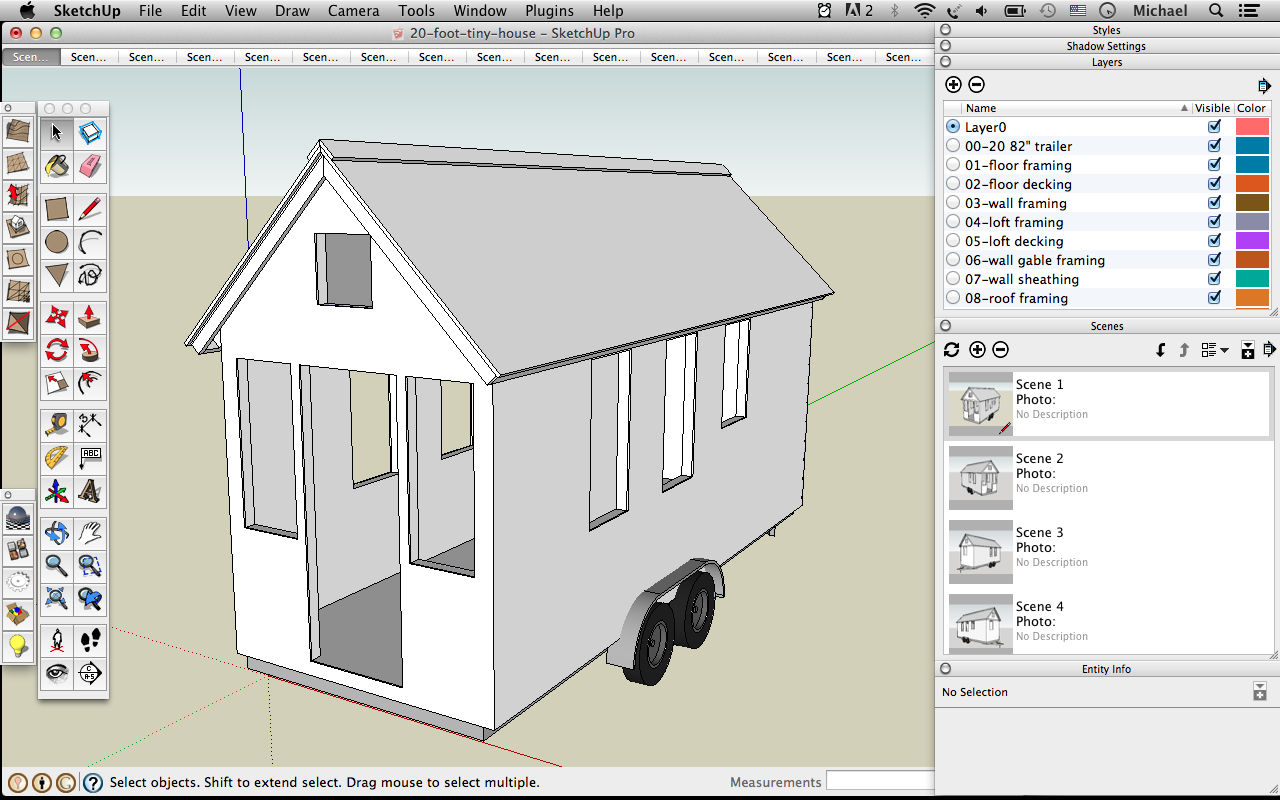

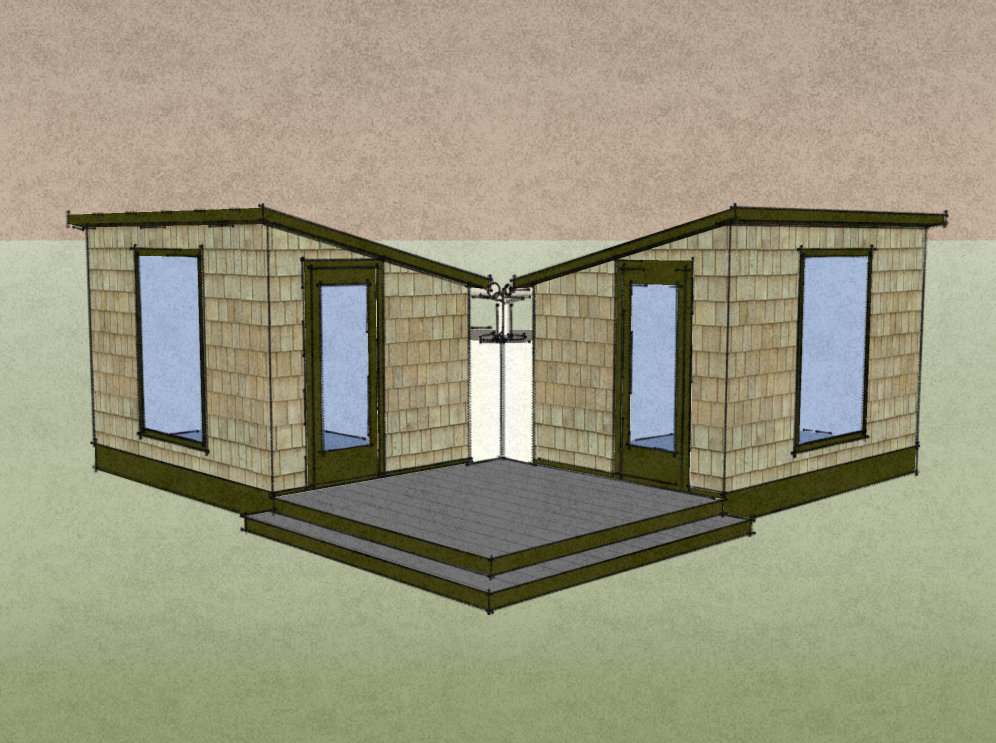

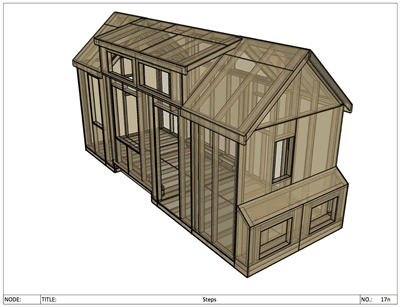

For example, what if you had a tiny house in the backyard and a truck to tow it? You might have had to spend as much as $50,000 to build the house and buy the truck – but you’d probably be using those to possessions all the time too. The truck may not be your daily driver, but it earns it keep with the fun & work it can take you to. The tiny house may not currently be your primary residence, but you can use it everyday as a guest room, home office, kid’s play room, or craft studio.

In other words, having a tangible tiny home on wheels that’s paid off – and the means to move it – can be part of your backup retirement or unemployment plan.

With a tiny house as part of a backup plan you live with the comfort that in a pinch, you’ll have a roof over your head. Your expenses would stay low due to the lower cost of ownership of tiny houses. The most complicated part will be finding a place to park your tiny home, but there are websites to help with that and worse case scenario, hooking up at a mobile home park, friend’s rural backyard, or even a campground, can work in a pinch.

Is a tiny house retirement for everyone? No, but it can be an excellent transition plan for those that don’t feel they could make it work long term.

This is food for thought. It’s an option many people have considered and some have put into action. It’s also just one of the many tangible assets you might consider on days like today, when markets globally are in turmoil.

![The Real [hidden] Value of Tiny Houses](https://tinyhousedesign.com/wp-content/uploads/2015/07/Tiny-House-Design-Living.jpg)

we purchased some land and built a tiny guest house for our retirement …….then came the crash of 07/08. we had already had blueprints drawn up for our new retirement home….we came out with enough for a well and septic but lost everything else….We are very thankful for our paid for tiny home. Don’t miss all the stuff it was by accident we did as you recomended

Great success story!

“We saw people loose so much equity in their homes it pushed them into foreclosure and bankruptcy. The big lesson learned is that outside forces are also sometimes outside our ability to manage comfortably. To avoid disaster, consider taking more control of your assets and hold them yourself.”

Truer words were never spoken. Our life took a serious downward spiral starting in 2008. We were able to hold on until 2012 when I just walked away from our home of 20+ years. I took my good junk tools and toys and rented a 3000 sq ft storage building for $200.00 a month, Needing a place to live I built a 500 sq ft tiny house in one corner of the building, It has been home for almost 2 years and has allowed me to get on top of personal debt and can proudly state I am COMPLETELY free and clear of any and all debt.

$50k is a lot of money to throw at an asset that for the most part goes down in value. If emergency shelter is necessary and you have land available, if would be much easier to buy a regular RV when the time come that can be pulled by a 1/2 ton truck instead of the 1 tons required to pull most tiny houses. That way you can have $50k in an emergency fund with $10k of that set aside for this truck and rv purchase. Also $50k buys a lot of rent. If housing is the main objective, most parts of the country, that could be 4-5 years of rent.

If the goal is retirement, then its a more planned and sorted out decision. Land or plans to be nomadic will be in place. The regular house will be sold at some point. But buying a truck to tow the home prematurely will result in having to pay maintenance, registration and depreciation on a vechicle that may not have any other purpose.